The web is increasingly becoming autonomous, enabled by Agents. The trend started with software automation in the 1980s and 1990s, with more components automated in each successive decade. This evolution is now moving to the web, enabled by agents trained on LLMs with large context windows that can decipher topics and take action.

You may not have heard of AI agents yet, but chances are you might already be using an early version of one. When you prompt ChatGPT or Claude to “find me everything you can on topic X,” its web browsing agent goes out on the web, finds all the information on the topic, and presents it to you in a coherent format and structure. This is what I describe as a research agent in the framework below.

As we head into 2026 and agents become more mature, we will see more coherent and complex use cases emerge. Need to book a vacation? Let the travel agent search, find, and present the perfect vacation for you based on your selection criteria—rather than spending hours across multiple sites booking flights and hotels. Need to find an item to buy? A shopping agent will do the mind-numbing search for you, presenting options in seconds that you can chat with to find your perfect items. When you’re ready, simply click buy and a payment agent will go to the vendor site and process the payment for you.

We are increasingly heading toward an autonomous web where agents will handle most of our mundane tasks.

The AI agent landscape has evolved from experimental chatbots into a sophisticated ecosystem of interconnected systems. According to Anthropic’s 2026 State of AI Agents Report (surveying 500+ technical leaders), 57% of organizations now deploy agents for multi-stage workflows, with 80% reporting measurable economic returns.

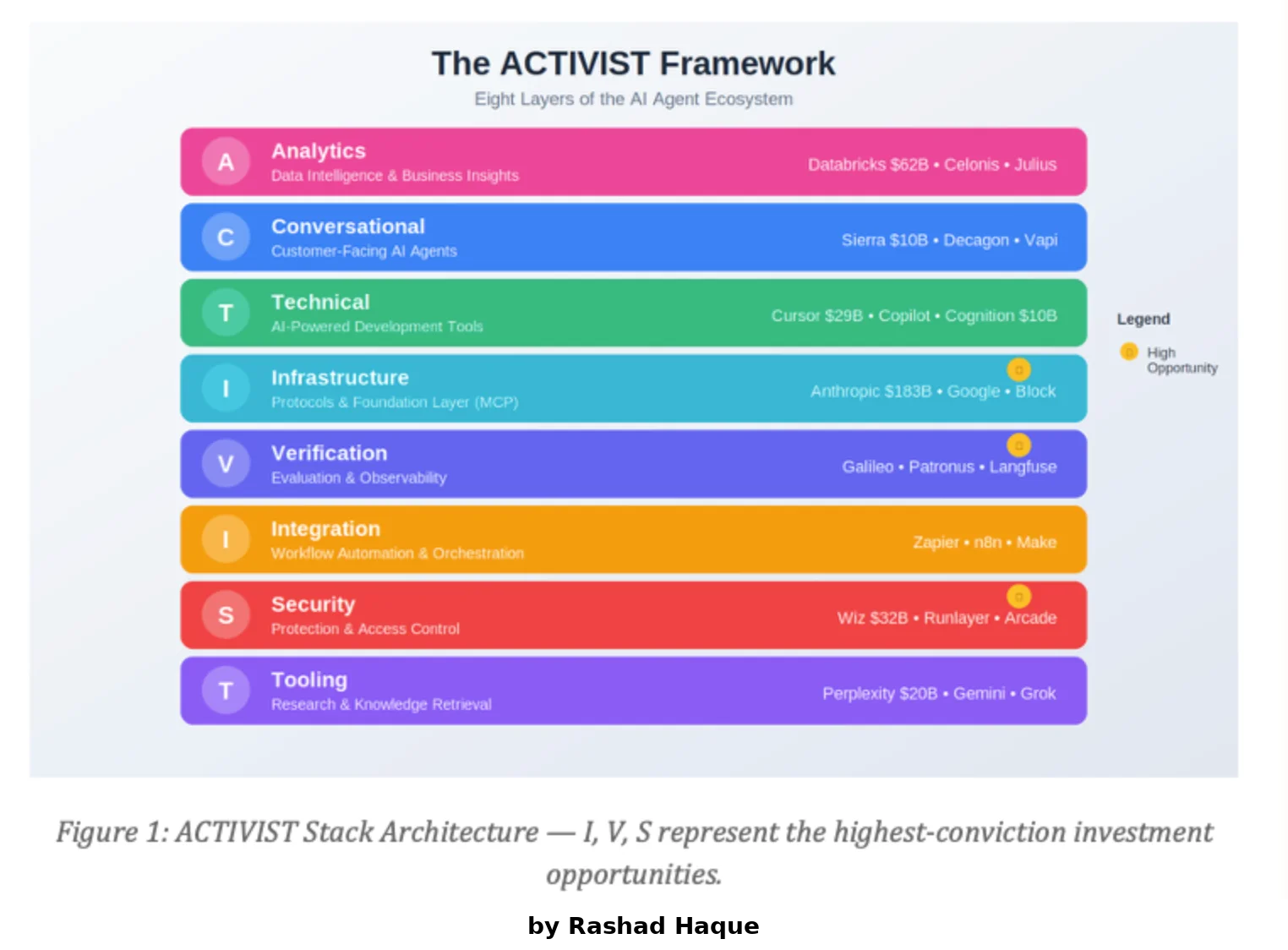

The ACTIVIST framework provides a structured approach to understanding this complexity, organizing the market into eight distinct layers. This analysis integrates the “Agentic Economy” research—which identifies foundational problems in building the Internet of AI Agents—with real-world deployment data from the 2026 Report.

With 57% of organizations deploying multi-stage workflows and 80% reporting measurable ROI, the AI agent market has reached an inflection point. The ACTIVIST framework maps eight layers of the agent stack to identify where value will concentrate:

- Infrastructure (I): MCP solves the #1 challenge (46% cite integration). Anthropic’s $183B valuation validates the protocol layer.

- Security (S): Wiz’s $32B acquisition proves enterprise willingness to pay premium for agent authentication.

- Verification (V): Critical gap—only 52% have evals despite quality being the #1 production barrier (32%). Underfunded opportunity with 65% CAGR.

2026 State of AI Agents: Key Findings

Anthropic surveyed 500+ technical leaders to understand current AI agent adoption:

- 57% deploy agents for multi-stage workflows; 16% run cross-functional processes

- 81% plan more complex use cases in 2026 (39% multi-step, 29% cross-functional)

- 90% use AI for development; 86% deploy agents for production code

- 80% report measurable economic returns from AI agent investments

- 46% cite integration with existing systems as primary challenge

- 77% of business API usage shows automation patterns (delegating, not collaborating)

Investment Thesis

The ACTIVIST framework reveals distinct investment opportunities across layers. Security (S) and Infrastructure (I) represent the highest-conviction opportunities—addressing the most fundamental Agentic Economy challenges while commanding premium valuations.

- Infrastructure (I): #1 challenge is integration (46%). MCP solves this. Anthropic at $183B.

- Security (S): Data access/quality (42%) requires secure agent auth. Wiz $32B validates demand.

- Verification (V): Quality is #1 production barrier (32%). Only 52% have evals. Underfunded.

- Technical (T): Coding leads adoption (90%). Winner-take-most: Cursor $29B, Cognition $10B.

Market Sizing & Growth Dynamics

Understanding market scale and growth trajectories across ACTIVIST layers:

| Layer | Current TAM | 2026-2030 CAGR | Penetration & Drivers |

| Infrastructure (I) | $12B (API management, integration platforms) | 42% | Only 46% have solved integration. MCP standardization accelerates adoption. |

| Security (S) | $8B (cloud security, IAM) | 38% | Agent authentication is greenfield. Wiz acquisition validates premium pricing. |

| Verification (V) | $2B (testing, observability) | 65% | Only 52% have evals. Quality (#1 barrier) drives urgent need. Fastest growth. |

| Technical (T) | $15B (developer tools) | 48% | 90% already using AI for dev. Expansion to production deployments (86%). |

| Analytics (A) | $28B (BI, data platforms) | 22% | Mature market. 60% cite high impact. Growth from conversational interfaces. |

| Integration (I-2) | $18B (workflow automation) | 35% | 57% deploy multi-stage workflows. 81% planning expansion. |

| Conversational (C) | $6B (CCaaS, chatbots) | 52% | 26.5% most common use case. Voice agents (Vapi <500ms) expanding TAM. |

| Tooling (T-2) | $4B (enterprise search) | 55% | 56% planning research agents. Perplexity (780M queries/month) proves demand. |

Key Insight: Verification (V) shows highest CAGR (65%) despite smallest current TAM ($2B). Classic underfunded opportunity—quality is #1 production barrier but only 52% have evaluation infrastructure. Risk-adjusted returns favor early bets here.

The Framework

Each letter in ACTIVIST represents a critical layer of the modern AI agent stack:

A — Analytics: Data intelligence and business insights

C — Conversational: Customer-facing AI agents

T — Technical: AI-powered development tools

I — Infrastructure: Protocols and foundation layer (MCP)

V — Verification: Evaluation and observability

I — Integration: Workflow automation and orchestration

S — Security: Protection and access control

T — Tooling: Research and knowledge retrieval

A — Analytics: Data Intelligence & Business Insights

The Analytics layer transforms raw data into actionable intelligence through AI-powered analysis. These platforms enable natural language querying of complex datasets, automated visualization, and predictive insights.

Per the 2026 State of AI Agents Report, data analysis and report generation ranks as the highest-impact use case (60%), with 56% planning to implement agents for research and reporting over the next year. L’Oréal achieved 99.9% accuracy on conversational analytics, enabling 44,000 monthly users to query data directly instead of waiting for custom dashboards.

Key Players

| Company | Description |

| Databricks ($62B valuation) | Leading data-and-AI platform with natural language querying. |

| Celonis ($13B valuation) | Process mining leader with AI-driven operational analytics. |

| Julius AI ($10M seed) | 2M+ users, 10M+ visualizations. Adopted by Harvard Business School. |

| Findly.ai | AI co-pilot for Business Intelligence with chat-based data exploration. |

C — Conversational: Customer-Facing AI Agents

The Conversational layer represents the front line of AI agent deployment—customer-facing systems that handle support, sales, and engagement. These agents manage millions of daily interactions with sophisticated dialogue management.

The 2026 Report shows customer service as the most common agent use case (26.5%). Thomson Reuters uses Claude to power CoCounsel, delivering 150 years of legal expertise in minutes.

Key Players

| Company | Description |

| Sierra ($10B valuation, $100M ARR) | Ex-Salesforce co-CEO. Powers AI for SoFi, Ramp, Discord. |

| Decagon | Conversational AI for customer experience with human-like interactions. |

| Vapi (Y Combinator) | Enterprise AI voice agents. Sub-500ms latency. |

| PolyAI | Production-grade voice assistants for call centers. |

T — Technical: AI-Powered Development Tools

The Technical layer leads AI adoption. Per the 2026 Report: nearly 90% of organizations use AI for development, and 86% deploy agents for production code. Time savings: planning (58%), code generation (59%), documentation (59%), code review (59%). Lovable ships code 20x faster than manual development.

Key Players

| Company | Description |

| Cursor ($29.3B valuation, $1B+ ARR) | Fastest-growing SaaS. Partners with Google, NVIDIA. |

| GitHub Copilot | World’s most adopted AI dev tool. 40% of GitHub revenue. |

| Cognition/Devin ($10.2B valuation) | Autonomous AI software engineer. Acquired Windsurf July 2025. |

| Replit Agent | Instant project bootstrapping from natural language. |

I — Infrastructure: Protocols & Foundation Layer

The Infrastructure layer provides foundational protocols enabling agent-to-agent communication. MCP has emerged as the de facto standard.

The 2026 Report identifies integration with existing systems (46%) as the #1 challenge. MCP addresses this. 77% of business API usage shows automation patterns—companies are delegating complete tasks to AI, not collaborating.

Key Players

| Company | Description |

| Anthropic/MCP ($183B valuation, $5B+ ARR) | Creator of MCP. Donated to Linux Foundation Dec 2025. |

| Google Cloud (MCP Servers) | Managed MCP for Maps, BigQuery, Kubernetes. |

| Dedalus Labs ($11M seed) | ‘Vercel for AI Agents.’ 130+ hosted MCP servers. |

| Composio ($25M Series A) | Tool-calling platform. 200+ enterprise customers. |

V — Verification: Evaluation & Observability

The Verification layer ensures AI agents perform reliably. The 2026 Report shows quality as the #1 production barrier (32%). LangChain survey: 89% have implemented observability, but only 52% have evals—a critical gap.

eSentire compressed expert threat analysis from 5 hours to 7 minutes, with 95% alignment to senior experts.

Key Players

| Company | Description |

| Galileo ($45M Series B) | Evaluation Foundation Models. 97% cheaper, 11x faster than GPT-3.5. |

| Patronus AI ($17M Series A) | Hallucination detection for regulated industries. |

| Langfuse (19K GitHub stars) | Open-source LLM observability leader. |

| Datadog LLM Observability | Enterprise monitoring. SOC2/HIPAA compliant. |

I — Integration: Workflow Automation & Orchestration

The Integration layer connects AI agents with existing business systems. The 2026 Report shows 57% deploy agents for multi-stage workflows, with 81% planning more complex use cases in 2026. Internal process automation ranks as 2nd highest-impact use case (48%). 80% report measurable economic returns.

Key Players

| Company | Description |

| Zapier (8,000+ integrations) | Leading no-code automation with AI Agents and MCP support. |

| n8n (164K GitHub stars) | Open-source workflow automation with agent-to-agent patterns. |

| Make (formerly Integromat) | Visual automation with ‘Grid’ for enterprise AI. |

| Lindy.ai | Customizable AI agents with conversation memory. |

S — Security: Protection & Access Control

The Security layer addresses unique challenges of protecting AI agent systems. The 2026 Report identifies data access/quality (42%) and change management (39%) as top challenges.

As Arcade.dev notes, “the hardest part of deploying agentic workflows today is not intelligence, but secure and reliable access to production systems.”

Key Players

| Company | Description |

| Wiz ($32B acquisition by Google) | Largest cybersecurity deal of 2025. DOJ cleared Nov 2025. |

| Cloudflare AI Security Suite | AI Guardrails, Firewall for AI, AI Audit. |

| Runlayer ($11M seed) | MCP-focused security gateway. 8 unicorn customers. |

| Arcade.dev ($12M seed) | Agent authentication platform. OAuth for agents. |

T — Tooling: Research & Knowledge Retrieval

The Tooling layer provides AI agents with real-time research capabilities. The 2026 Report shows 56% plan to implement agents for research and reporting. Research & data analysis is 2nd most common use case (24.4%).

Companies making internal knowledge accessible to AI will capture disproportionate value.

Key Players

| Company | Description |

| Perplexity AI ($20B valuation, 30M+ users) | AI-powered search. 780M+ queries monthly. |

| OpenAI Deep Research | ChatGPT Pro ($200/month). Expert-level research. |

| Google Gemini Deep Research | Google’s search stack with multimodal capabilities. |

| xAI Grok DeepSearch | Real-time research with X (Twitter) access. |

Enterprise Case Studies

From the 2026 State of AI Agents Report:

Thomson Reuters: CoCounsel delivers 150 years of legal expertise and 3,000 domain experts in minutes

eSentire: Compressed expert threat analysis from 5 hours to 7 minutes (95% alignment with senior experts)

Doctolib: Claude Code replaced legacy testing infrastructure in hours vs weeks; ships features 40% faster

L’Oréal: 99.9% accuracy on conversational analytics; 44,000 monthly users query data directly

Lovable: Ships code 20x faster than manual development with agentic coding tools

Conclusion

The 2026 State of AI Agents Report confirms a clear pattern: organizations are shifting from simple task automation to complex, multi-step workflows that span teams and business functions. The question for leaders is no longer “whether” to adopt AI agents but “how” to scale them strategically.

The ACTIVIST framework identifies where value is being created:

- Infrastructure (I) and Security (S) command premium valuations by solving foundational integration and authentication challenges. Anthropic’s $183B valuation and Wiz’s $32B acquisition validate market willingness to pay for these layers.

- Verification (V) is underfunded but critical—quality remains the #1 production barrier, yet only 52% have evaluation infrastructure. This represents the highest-conviction contrarian bet: 65% CAGR in a $2B market expanding to $20B+ by 2030.

- Technical (T) exhibits winner-take-most dynamics. Cursor’s $29B valuation at <3 years old shows the velocity possible, but also the danger: late entrants face insurmountable distribution disadvantages.

The agentic economy is here. The question is not whether agents will transform work, but which layers of the stack will capture the value—and which investors will recognize the opportunity before premium valuations become consensus.

Sources

Anthropic: 2026 State of AI Agents Report (December 2025)

AI Venture Studio: MIT Media Lab

Project Nanda: MIT Media Lab — “The Agentic Economy” research

LangChain: State of Agent Engineering Survey (2025)

Company filings and press releases: Funding data verified December 2025